Impact Investment

What sets us apart is our unique approach to apartment ownership and development consulting. We pride ourselves on challenging conventional norms and thinking outside the box to bring fresh and innovative solutions to the table.

DISCLOSURES

Confidentiality & Disclaimer

This presentation (“Presentation”) has been prepared by Springboard Real Estate Advisors (“Springboard RA” or “Springboard”) for informational purposes only. It is confidential and intended solely for its designated recipients. Recipients may not reproduce, distribute, or share this Presentation or its contents, in whole or in part, in any form.

This Presentation does not constitute an offer to sell or a solicitation to purchase any securities or partnership interests. Prospective investors should carefully review all offering documents, including the private placement memorandum, operating agreement, and subscription documents (collectively, “Investor Documents”), and consult their legal, financial, and tax advisors before making any investment decisions.

The information contained herein is a summary of Springboard RA’s business as currently contemplated and is subject to change prior to finalization of the Investor Documents. This Presentation is not exhaustive and is superseded entirely by the Investor Documents. Past performance is not indicative of future results, and individual investment outcomes may vary. Future deal flow is not guaranteed. Certain statements in this Presentation, including those using terms such as “targets,” “expects,” “intends,” “estimates,” “projects,” and similar expressions, are forward-looking and based on assumptions that involve risks and uncertainties. Actual results may differ materially due to various factors, including those outlined in the “Risk Factors” section of Springboard RA’s private placement memorandum.

INVESTMENTS IN SPRINGBOARD RA INVOLVE RISK. Numerous factors may cause actual results, performance, or achievements to differ materially from any projections or expectations expressed in this Presentation.

WHY PARTNER WITH US?

At Springboard, our leadership and team are dedicated to achieving results through a strategic advisory approach. The launch of our new fund represents a natural evolution in our mission—offering investors a passive alternative to traditional fixed-income investments. Designed to deliver high-impact returns while safeguarding investor capital, the fund provides a more secure and attractive option in today’s market.

With a proven track record in mortgage banking, we have advised, invested in, and funded over 2,000 loans, totaling more than $1.5 billion. Our extensive expertise in private mortgage lending, real estate development, and property management—owning and operating over 16,000 apartment units—gives us a distinct competitive advantage.

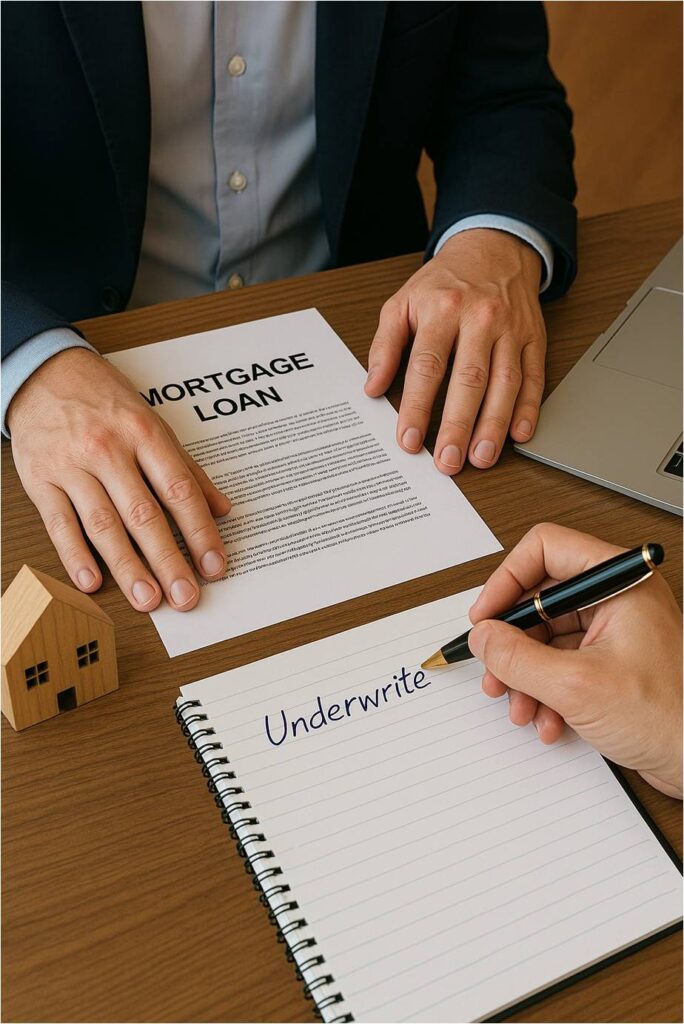

Springboard Real Estate Investments XI is structured to minimize investor risk through prudent underwriting, diversification via a pool of mortgage-backed securities, and targeted investments in carefully selected, shovel-ready projects. By focusing on high- potential developments and leveraging a broad portfolio of mortgage products, we bring stability and control to key markets, ensuring strong, consistent returns for our investors.

NICHE OPPORTUNITIES

Non--Owner--Occupied Single Family Residential

Target LTV: 60% to 65% (or less) Maximum: 70%

Multi-Family Properties¹

Target LTV: 60% to 65% (or less) Maximum: 70%

Non--Owner--Occupied Single Family Properties

Target LTV: 60% to 65% (or less) Maximum: 70%

Construction Loans³

Target LTV: 60% to 65% (or less) Maximum: 70%

Impact Investments

Dreamville Kaukauna Apartments

More details Hope Housing Foundation is pleased to share this project with you. Hope Housing Foundation is pleased to share this project with you. We have compiled an overview of the development in a Dropbox folder which includes the renderings, the appraisal, our lender commitment letter, and the current loan sizing. If you're interested in the details, please reach out to let us know. Also included are additional funding sources that have already or will be deployed to the project. The overall investment opportunity includes in this transaction was an investment of $10M in the form of debt that will be used to promote the development of work force housing in Kaukauna, WI. These funds were to be used to stabilize an investment opportunity being funded by tax exempt bonds for the promotion and creation of Work Force Housing. Section 103 of the Tax Code allows us to invest in a transaction that promotes or creates housing for individuals and families in certain income brackets and allows those gains to be totally excludable from the gross income of the debt holders. The area median income for Kaukauna, WI. is $72,448. Fifty (50%) of the units will be set aside to provide housing for individuals that make 80% of this income, therefore accommodating 95% of the workforce in the Community.

Global Communications Support

More details Hope Housing Foundation is pleased to share this project with you. Hope Housing Foundation is pleased to share this project with you. We have compiled an overview of the development in a Dropbox folder which includes the renderings, the appraisal, our lender commitment letter, and the current loan sizing. If you're interested in the details, please reach out to let us know. Also included are additional funding sources that have already or will be deployed to the project. The overall investment opportunity includes in this transaction was an investment of $10M in the form of debt that will be used to promote the development of work force housing in Kaukauna, WI. These funds were to be used to stabilize an investment opportunity being funded by tax exempt bonds for the promotion and creation of Work Force Housing. Section 103 of the Tax Code allows us to invest in a transaction that promotes or creates housing for individuals and families in certain income brackets and allows those gains to be totally excludable from the gross income of the debt holders. The area median income for Kaukauna, WI. is $72,448. Fifty (50%) of the units will be set aside to provide housing for individuals that make 80% of this income, therefore accommodating 95% of the workforce in the Community.

Selling transportation business

More details Hope Housing Foundation is pleased to share this project with you. Hope Housing Foundation is pleased to share this project with you. We have compiled an overview of the development in a Dropbox folder which includes the renderings, the appraisal, our lender commitment letter, and the current loan sizing. If you're interested in the details, please reach out to let us know. Also included are additional funding sources that have already or will be deployed to the project. The overall investment opportunity includes in this transaction was an investment of $10M in the form of debt that will be used to promote the development of work force housing in Kaukauna, WI. These funds were to be used to stabilize an investment opportunity being funded by tax exempt bonds for the promotion and creation of Work Force Housing. Section 103 of the Tax Code allows us to invest in a transaction that promotes or creates housing for individuals and families in certain income brackets and allows those gains to be totally excludable from the gross income of the debt holders. The area median income for Kaukauna, WI. is $72,448. Fifty (50%) of the units will be set aside to provide housing for individuals that make 80% of this income, therefore accommodating 95% of the workforce in the Community.

What clients say about us

Best practices with strong business and pragmatic local knowledge

Angela Daniels

I loved their feedback. I gained absolute value. Their speed, friendliness, and most of all knowledge; helped me in ways unimaginable.

Oliver James

Thanks guys. I appreciate the strategy and quick responses for my project needs.

Henry Tatom

Great service. I look forward to utilizing services again soon.

David Liam

Customer Service is exceptional! I appreciate the one on one experience with the team. I was always in the loop about my project and the they were able to bring everything to a close with even saving me some coins.

Let us help you!

Questions about our firm or the future of commercial real estate? We’re here to help.